Auction market as builder and buffer for the NFT Market

[2022年04月05日]Traditional auction houses have been playing a launchpad role in NFT trading, but they could provide greater stability for this growing market. By providing valuation estimates, they synthesize the current state of supply and demand; by selling an NFT, they provide a reference price that is independent of the prices practiced on peer-to-peer platforms (like Opensea, Nifty Gateway, SuperRare, etc.). In other words, with their expertise and their temporization of the market, the auction houses may well have a stabilizing effect on the effervescent NFT market.

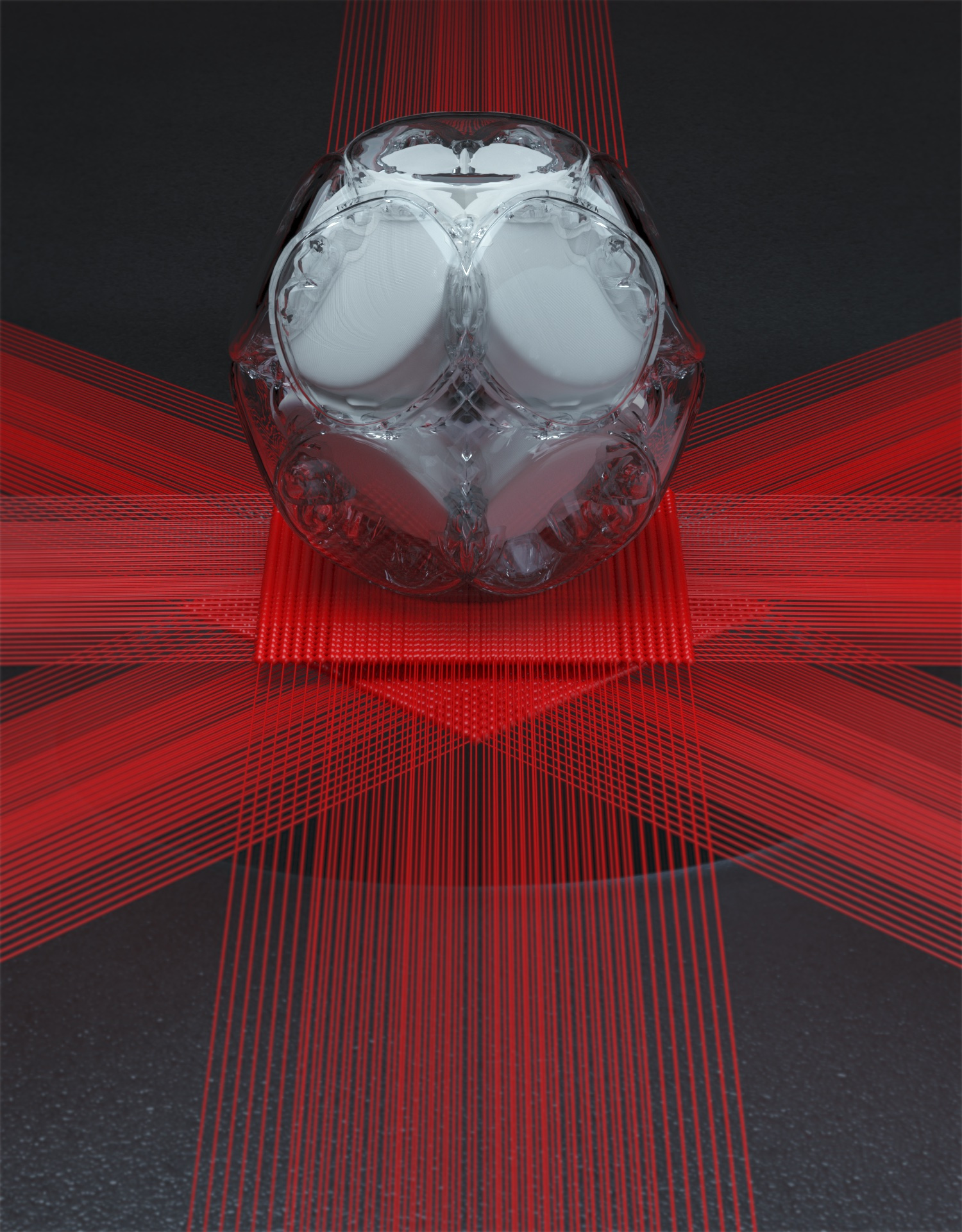

Abdoulaye Barry, Globule blanc (2022). Paper print + NFT. Estimated €500 – €800, sold €1,080 by FauveParis auction house in Paris on 10 March 2022

.

thierry Ehrmann, CEO and Founder of Artmarket.com and its Artprice department: “By preparing a sale, publishing a catalog several weeks in advance and by giving a range of estimates and guaranteeing the information long after adjudication, the auction house actually ‘moderates’ the NFT market. This does not prevent prices from soaring if demand is stronger than expected”.

Despite the transparency of blockchain technology, there are plenty of anomalies on major NFT marketplaces. Whether it’s fake accounts (like those that appeared around Takashi Murakami) or arbitrage opportunities (offered to those who manage to integrate the whitelists of the most coveted projects), NFT sales platforms have seen a large number of highly aggressive strategies contributing to price volatility and a degree of instability.

Takashi Murakami’s ‘overly’ anticipated NFTs

Since the announcement of his Flowers NFT project, Japanese artist Takashi MURAKAMI (ranked 105th in our global ranking of artists by 2021 auction turnover, all periods of creation combined) has been the subject of numerous fraud attempts using Instagram and Twitter accounts with deliberately similar names, such as murekemi.flower2022. By inciting you to mint NFTs as quickly as possible (as most NFT drops do), these fake projects try to make you buy instantly, without checking the legitimacy of the creator.

It is clear that Murakami’s NFT project is attracting interest from both traditional collectors and from the crypto community. However, it is looking increasingly likely that his Flowers NFTs will not be launched until around the time of his solo show at the Gagosian in New York, scheduled for May 2022. We will therefore have to wait a little longer than was initially expected to buy into Murakami’s digital Flowers.

Unfortunately, the lack of clarity that currently exists on NFT marketplaces as well as on social media is generating a large number of scams. Almost all of today’s most famous NFT projects have replicas circulating in large numbers on Opensea. This situation could be improved by a more active presence of stabilizing agents such as auction houses in the NFT ecosystem.

At last… a genuine reference price

Of the 10,000 items in the World of Women collection, only one copy went to public auction. Estimated between $400,000 and $665,000 by Christie’s, Woman #5672 was sold on 1 March 2022 in London for $600,000 (to which a 26% buyer’s fees was added, bringing the total purchase price to $755,000).

The value of this work fitted perfectly with the estimate provided by the auction house Christie’s. However, the price of this NFT has been very volatile: barely six months ago, Woman #5672 was acquired for $117,000 (37.95 eth) on the OpenSea platform, and the best offer for this NFT is today $70,000 (20 eth).

Because it was outside the blockchain, data relating to Christie’s sale does not appear in the work’s activity log on OpenSea. On the other hand, the identity (or rather the pseudonym) of the buyer of Woman #5672 has been revealed by Opensea: it is the moonpay.eth account. In this way, the OpenSea platform and Christie’s auction house both provide two complementary bits of information.

0

0