After two years of exaltation, a certain calm has prevailed

The Ultra-contemporary art market settled to a sensible cruising speed after the flamboyant momentum of the post-Covid era.

They are less than 40 years old, are courted by powerful art galleries and bring plenty of spice to auctions in New York, London and Hong Kong: the new darlings of Contemporary art (the ‘Ultra-contemporaries’) have reached impressive prices at lightning speeds. Some of them have produced canvases that reached several million dollars at auctions last year: $3.6 million for a work by Flora YUKHNOVICH and $5.2 million for another by Avery SINGER… amounts that were inconceivable ten years ago for such young signatures.

The Ultra-contemporary art segment has gained in density with a sharp increase in the number of artists under 40 entering the auction market since the start of the millennium. Indeed, today it concerns about 2,600 artists whereas 20 years ago they numbered roughly 500. This expansion of the market and, above all, the extremely high valuations attributed to works by a select few young artists has ended up representing an increasingly interesting market segment in its own right.

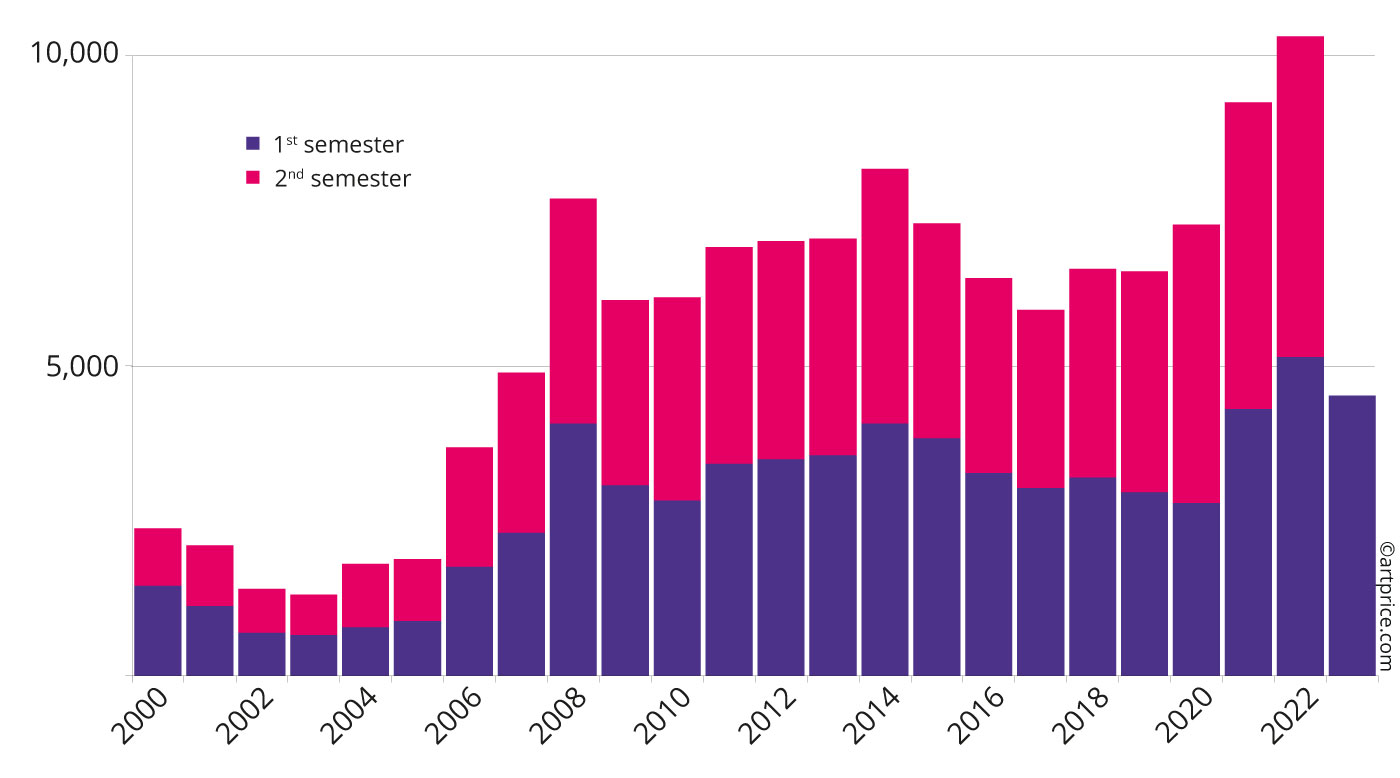

After the health crisis – a long period of restricted art market activity – buyers wanted to reconnect with artistic creation by acquiring works of very young artists, particularly at auction. It was a veritable rush for the freshest, newest works. Bidders enthusiastic about the very idea of ‘new creation’ raised the auction turnover contribution from artists under 40 to over $200 million for three consecutive semesters, between H1 2021 and H1 2022. Last year, the momentum slowed and the results were more balanced, in line with the general trend of the art market as a whole.

After the peaks recorded between January 2021 and June 2022, Ultra-contemporary art generated $127 million in H1 2023. Mirroring the fine art auction market as a whole, the slowdown in turnover from Ultra-contemporary art this year was due to a contraction of the number of ultra-high-end transactions: results in the six or seven digits range shrank by almost 45% in comparison with the first half of 2022.

Although the high-end segment was generally thinner on the ground last year, the majority of collectors remained eminently active at auctions. In fact, the level of demand is impressive, with more than 4,500 Ultra-contemporary works exchanged in H1 2023, compared with an average of 3,000 every semester before the health crisis.

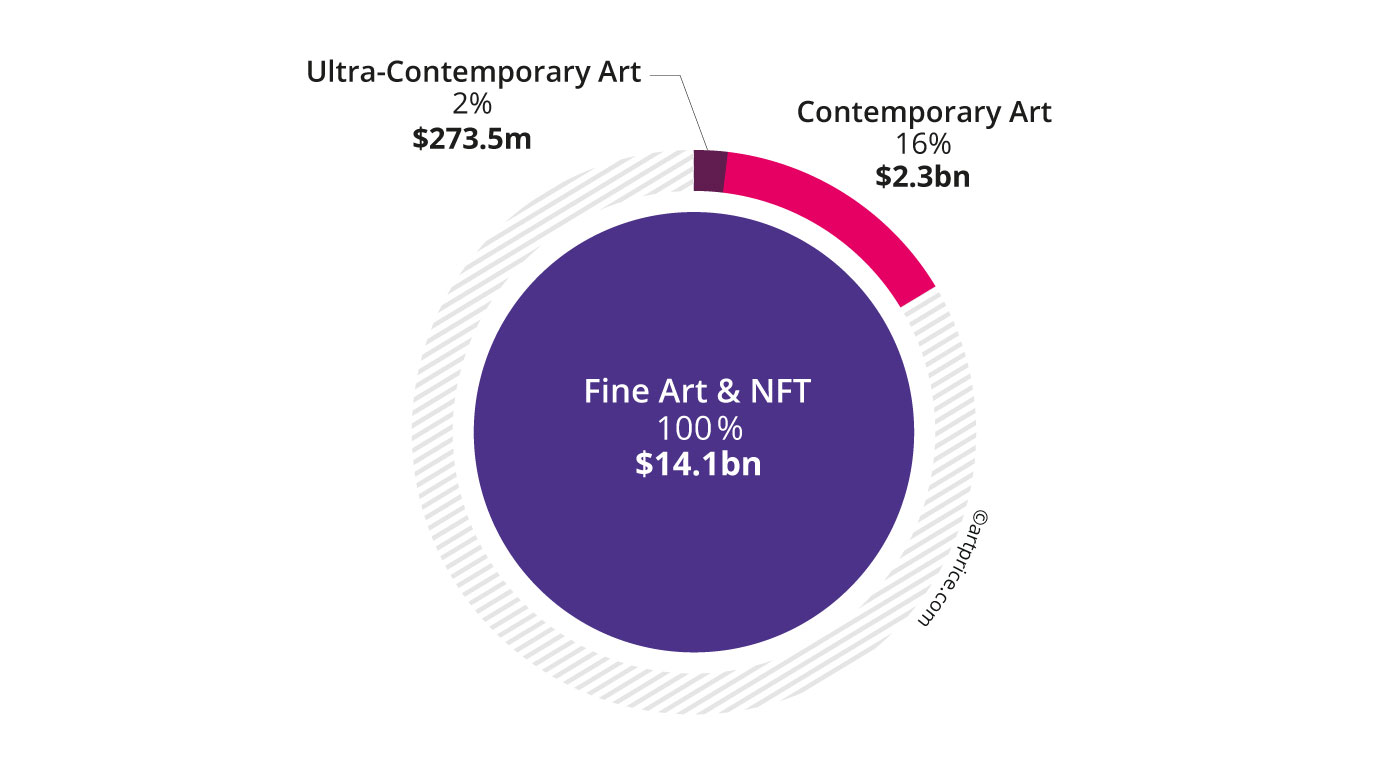

Relative shares of Contemporary and Ultra-contemporary segments in global fine art auction turnover (2022/2023)

Lots of lots…

More than 4,500 artworks by young artists found buyers in the first half of 2023, a particularly high number. Indeed, the threshold of 4,000 transactions per semester has only recently stabilized (since 2020). Moreover, the unsold rate on Ultra-contemporary art (33%) is now the same as that observed for Contemporary art, suggesting an optimal supply/demand equilibrium. Transactions on ‘recent’ works are therefore following the same positive dynamic we have seen on the Contemporary art market, which also posted a record number of transactions this past year.

Transactions slowed at the high end, but were still accelerating for works valued below $50,000.

The first semester of 2023 saw a variable transaction dynamic according to the different price ranges. As expected, after a year and a half of galloping ahead, the big results have shrunk in number with 45% less works over $100,000, and the number of 7-digit results dropping from 32 to 13. Less impatient and less impulsive than at the end of the Covid restrictions, bidders refocused their passion towards the more affordable price ranges. While the pace of transactions remained constant for lots valued between $1,000 and $10,000, it progressed in the higher price level ($10,000 – $50,000) by 5% versus H1 2022.

Half-yearly change in the number of Ultra-contemporary works sold at auction (H1 2023)

The young stars

The deceleration of the high-end market naturally impacted the auction turnover figures of most valued new signatures. Flora Yukhnevich and Christina Quarles ranked in the Top 10 last year, but this year their auction turnovers both lost 80%. However, a few months after the breathtaking records hammered for these two young artists, the market’s restraint seems salutary. This past year, opportunities to acquire their works at auction were rare and none of their works remained unsold. It is therefore much more a question of market regulation than of disaffection for their works.

In the case of Matthew WONG, the most expensive Ultra-contemporary on the market, his half-year turnover lost just over 5 million dollars due to the scarcity of his works at auction. Five were sold during H1 2023 compared with eight in H1 2022. Considering that his best works can easily exceed four million dollars, their relative scarcity this year was the sole factor responsible for Wong’s lower half-year total and his market is definitely holding up. In H1 2023, all his paintings offered sold within their estimate ranges (or above) and the price trend is still rising for his best works. For example The Jungle (叢林) (2017), sold for $1.75 million in May at Sotheby’s in New York, although it remained unsold a year earlier in Hong Kong despite a lower low estimate ($1.2 million). Another reassuring sign for his market was the sale of his River at Dusk (黃昏的河流) (2018) with a capital gain of +37% after two and a half years: Sotheby’s HK sold the work for $6.66 million compared with $4.87 million in 2020 at Phillips HK.

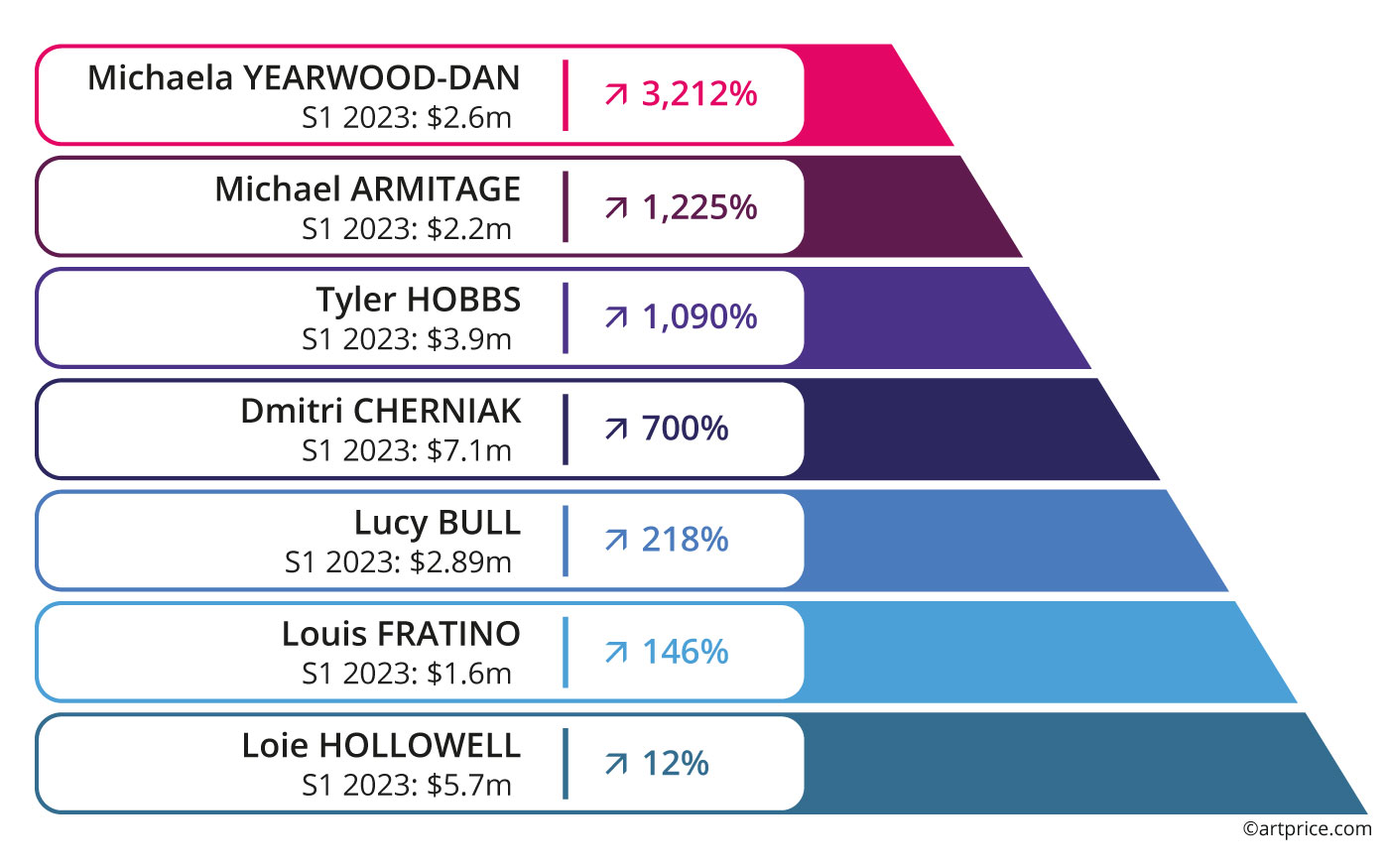

Having taken works by Yukhnevich, Quarles and Wong to multi-million dollar prices, major collectors are becoming increasingly committed to other very promising young artists. The young American, Loie HOLLOWELL, is an example of this: her prices have been steadily climbing since she has been supported by the Pace gallery, i.e. since 2017, and she has just reached a new record at $2.29 million in Hong Kong (Standing in Red (站立於紅色), Sotheby’s). Among her seven canvases sold at auction in H1 2023, none disappointed vs. their pre-sale estimates, and her work generated $5.7 million establishing her as the third top-selling Ultra-contemporary at auction.

In her 40th year, Loie Hollowell is third in our Ultra-contemporary ranking and signed an auction record of more than $2 million in Hong Kong.

In 22/23, Michael ARMITAGE was also honored with a new auction record of more than $2.2 million when his painting “Muliro Gardens (baboons) “ (2016) was offered at Sotheby’s in London. Now represented by the David Zwirner gallery in addition to the White Cube, Armitage has a truly exemplary CV, fully justifying this 7-digit price level: in 2018, his canvas Necklacing was purchased by the New York MET from the White Cube; in 2019, his works caused a sensation at the 58th Venice Biennale (May you live in interesting times) and at the MoMA (Projects 110: Michael Armitage), while his canvas The Conservationists (2015) rocketed past the estimates provided by Sotheby’s New York to reach $1.52 million (i.e. 25 times its mid-range estimate). Since then, his visibility and reputation have continued to grow, particularly after his solo exhibition Paradise Edict which moved to the prestigious Royal Academy of Arts in London in 2021, after showing in Munich. Armitage is essential but very difficult to buy, because his galleries have a tight control over his market and have successfully created scarcity. His Muliro Gardens (baboons) may have fetched over $2 million dollars, but it was his only major canvas to be auctioned in 2023.

Other young to artists attract big spenders include Michaela YEARWOOD-DAN, leading a movement of emerging black abstract artists. This new rising star, established in London, sparked aggressive bidding at Christie’s in late February, reaching a record result of $884,000 for her Love me nots (2021). The final price exceeded the recommended price by over ten times, the high estimate having been set at $72,000.

Let us also mention Louis FRATINO, whose three canvases offered during the major Christie’s and Sotheby’s sales in May all exceeded their high estimates, and Lucy BULL, who has tripled her previous year’s turnover and is currently ranked 9th in the our Top 10 Ultra-contemporary ranking. The good performances of these artists in high demand are based on a slightly more generous offer than last year.

Some auction turnover totals have risen (H1 2023 vs. H1 2022)

A tighter market with a less abundant supply

Rarity is a powerful valuation criterion on the Ultra-contemporary segment where 75% of the most highly-priced artists generally sell less than ten lots in six months. For example, only one lot was presented in H1 2023 for the highly sought-after Noah Davis and Akunyili Akunyili Crosby. Avery Singer is in the semestrial Top 10 with just two results, while three works were offered for each of the coveted signatures Christina QUARLES, Issy WOOD and Lucas ARRUDA.

These new emblematic artists are represented by powerful international galleries – Pace, Miro, Gagosian, Zwirner, Hauser & Wirth and various others – who control the placement of works to avoid speculation on the secondary market. Galleries are wary of the runaway effect that quickly propels young artists to price levels worthy of those paid for already established Contemporary artists. There is always a risk that the market will run out of steam, move on and the rating will plummet after exploding too fast. The galleries therefore try to control the evolution of the prices of their proteges so that they remain constant and sustainable.

It can also be difficult for these large galleries to satisfy strong international demand for the works by young recruits whose production is limited. The patience of collectors is sometimes tested by long waiting lists before a work is finally available. Given the tension maintained by the competent galleries and the rare opportunities offered on the secondary market, the most motivated collectors are ready to make big bids at auction, even if it means buying “against the market”, i.e. higher than the prices set by the gallery (or galleries).

NFTs, recovery on stabilized ground

Two years after the totally unexpected sale of BEEPLE Everydays: The first 5000 Days《每一天:前5000天》for $69.3 million, NFTs occupy a much more modest place on the art market after the sharp mechanical contraction in 2022 linked to major fluctuations of crypto-currency prices, on which NFTs are indexed. The collapse of crypto-currencies (-63% for Bitcoin in 2022 and -82% for Ethereum compared to its all-time high in November 2021) has considerably impacted the attractiveness of this market.

Since then however, the ground has stabilized and the auction houses are continuing to explore this new territory, with notable successes: those of Dmitri CHERNIAK and of Tyler HOBBS notably, two generative art pioneers who rank 2nd and 6th respectively in our global ranking of Ultra-contemporary Art (based on H1 2023 auction turnover) with new 7-digit records.

Two digital artists, Dmitri Cherniak and Tyler Hobbs rank in the global Top 10 Ultra-contemporary artists.

Sotheby’s hammered the new records for both Cherniak and Hobbs. This is not surprising because the American company has recently extended its activities to digital art, launching its Sotheby’s Metaverse platform in 2021, then its own NFT marketplace in May 2023. This year, Sotheby’s obtained the sale of an exceptional batch of NFTs from the Three Arrows Capital collection, a large crypto hedge fund that filed for bankruptcy in 2022. Within this rare collection, Fidenza #725 (2021) by Tyler Hobbs reached a million dollars against a high estimate of $180,000, while Ringers #879 (The Goose) (2021) by Dmitri Cherniak (1988) reached $6.2 million against an already substantial estimate of $3 million. Regulated auction sales of works by Dmitri Cherniak reached $7.1 million in H1 2023, accounting for half of the total auction turnover from Ultra-contemporary NFT sales over the same period.

With a total of $14.2 million (compared with $5.3 million in H1 2022), NFTs represented a not inconsiderable share of 11% of the turnover from the Ultra-contemporary art segment. Generative art is therefore establishing its place on the auction market and, according to Sotheby’s and Christie’s, attracting the attention of a growing audience. Not to be outdone, several major international art institutions have extended their acquisition strategies to include NFTs.

At the beginning of this year, the Pompidou Center in Paris became the first French public museum to bring NFTs into its collections, while the MoMA has already built up a significant fund to deploy its collections towards digital art in the form of NFTs.

The imminent boom in NFTs is being driven by major technological advances and developments that we mentioned in our previous report on the 2022 Global Art Market. These include, notably, the decarbonization of the Ethereum protocol following “The Merge” operation (September 2022). This update has switched the consensus mechanism from “proof-of-work” (PoW) to proof-of-stake (PoS) used for the validation of transactions on the blockchain. It has allowed Ethereum to reduce its energy costs by 99.9%. In the context of a global ecological crisis, this represents a major progress and it lifts a huge obstacle from the development of crypto-art and the market for artworks in the form of NFTs, which were singled out for their energy-hungry nature.

40.3

40.3