Blue-chip Artists

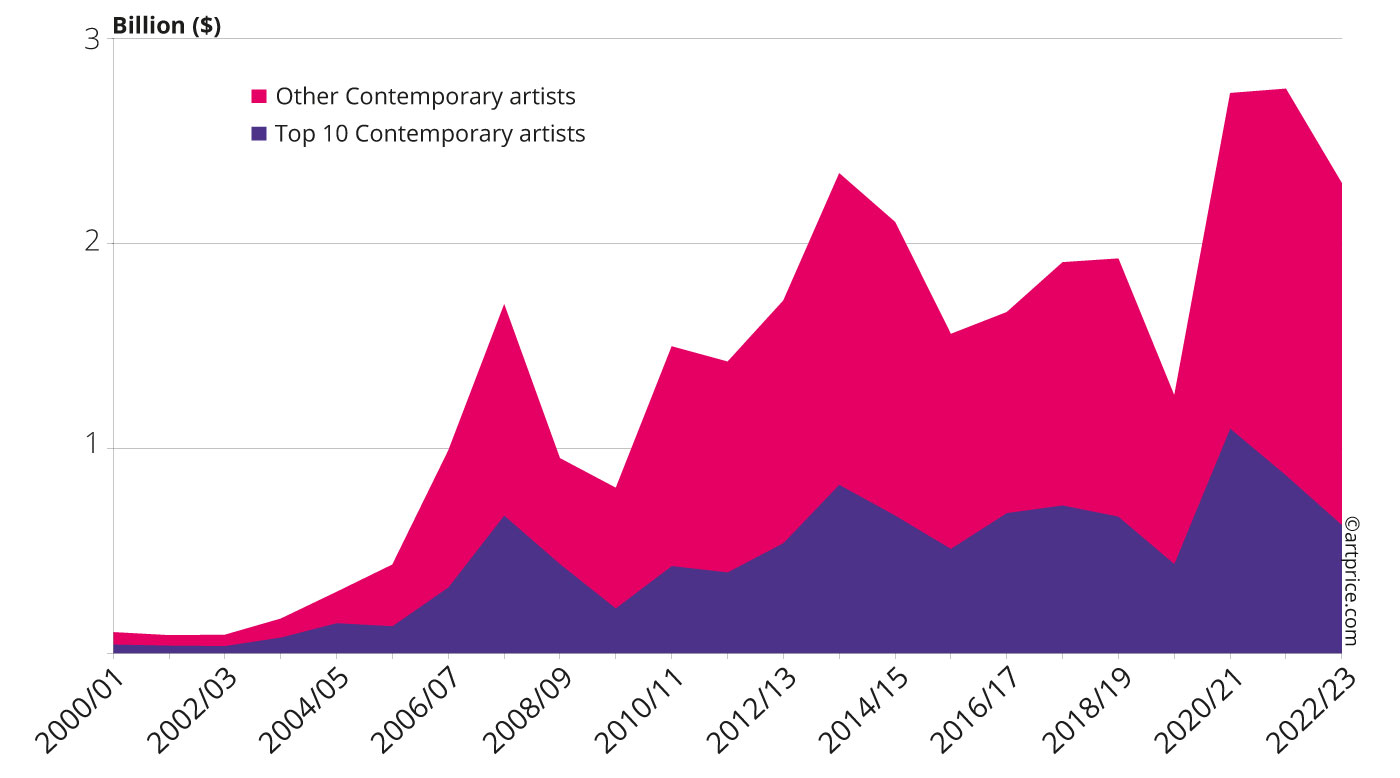

Major fluctuations in global art auction turnover result from the presence or absence of works by a small number of ‘blue-chip’ artists that can fetch tens of millions of dollars.

With works valued at tens of millions of dollars, the tutelary signatures of Contemporary Art represent a huge percentage of the segment’s auction turnover… in fact, no less than 85% of the global total (i.e. $1.9 billion) comes from the world’s 500 top-selling Contemporary artists, and almost a third of the world’s total turnover from Contemporary Art comes from just ten signatures.

While works by blue-chip artists clearly add prestige to collections, both public and private, the prices they fetch depend above all on the financial health of those who wish to obtain them, the millions they are ready to part with and the auction records they want to break.

After the opulence of recent years, the artists at the top of the pyramid are currently experiencing a cyclical downturn. In 22/23, the auction turnover for the top 10 stars of the Contemporary market shrank, collectively, by almost $188 million versus the previous year.

Top-selling artists’ contributions to global Contemporary art auction turnover

Top 500 artists: $1.9 billion, or 85% of global turnover

Top 50 artists: $1.164 billion, or 51% of global turnover

Top 10 artists: $630.2 million, or 27% of global turnover

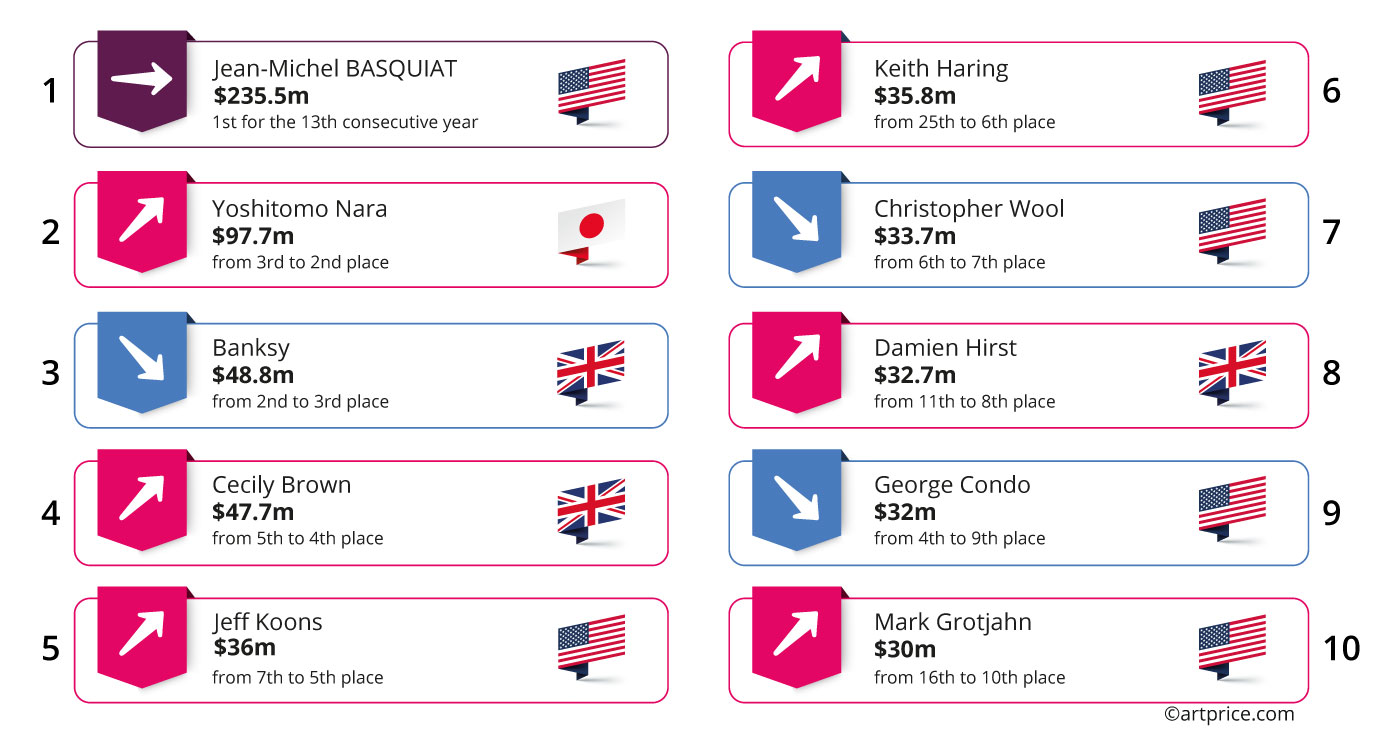

Contribution of Top 10 artists to Contemporary art auction turnover (2022/2023)

Of the ten most successful artists on the Contemporary Art market, BANKSY, ranked third in our global ranking but with a turnover down by $79 million vs. 21/22. This decline is based on two factors: a reduction of interesting pieces compared with those offered in 2021/2022, and the general return to a calmer mood at auctions. The flamboyant auctions of 2021 have – at least for the time being – given way to much greater sobriety. Last year, Banksy’s works fetched over $10 million on four occasions and even hit an unexpected result of more than 25 million dollars (Love is in the Bin). Several exhilarated collectors literally caused his prices to soar. One of his famous images – Love is in the air (15 copies and some artist proofs) – reached $12.9 million against an estimate of $3-5 million. In the fall of 2022, the most recent edition of the same work to be offered for sale fetched a much more sober $3.9 million, almost returning to its initial estimate.

This year, Banksy’s major works have all found buyers within their estimated ranges, exceeding them only rarely, and by little. However, the deceleration in the turnover generated by the artist has been accompanied by an upsurge in transactions. These results perfectly illustrate the adjustment that the Contemporary art market is currently undergoing: a less excited high-end segment and strong demand for more affordable works. Banksy’s auction transactions actually accelerated considerably this year (+55%), with more than 1,600 lots sold. The artist is in fact more in demand than ever before.

Ranking changes among Top 10 Contemporary artists (vs 2021/2022)

In 2022/2023, only four Contemporary artists elicited bids above $10 million: Jean-Michel Basquiat, Jeff Koons, Yoshitomo Nara (twice) and Christopher Wool, very few compared with the year-earlier period (2020/2021) when the $10 million threshold was crossed 26 times, notably for works by Banksy, Richard Prince, Peter Doig, Adrian Ghenie, but also by Chinese contemporaries Liu Ye, Zhou Chunya, Zhang Xiaogang, Chen Danqing, Liu Xiaodong, Leng Jun and Geng Jianyi, whose markets appear to have slowed. Indeed, the new sobriety of ultra high-end Contemporary art market has impacted the turnover figures of the major Western and Chinese signatures alike.

Corrections on KOONS and WOOL

On the micro-market for multi-million dollar Contemporary artworks, losses can be just as spectacular as gains. In 22/23, a major work by Jeff KOONS, Jim Beam – J.B. Turner Train (1986) – an iconic sculpture from his series Luxury and Degradation – suffered a substantial auction correction losing half its value in ten years. In 2014, this large polished steel model train (originally filled with whisky) fetched $33.7 million at a Christie’s sale hosted at a particularly auspicious moment for the art market. But it was also a key moment in Koons’ career because his work was being shown in a major retrospective at the Whitney Museum of American Art in New York (before moving to the Center Pompidou in Paris). Indeed, that same year his works generated over $100 million. In 22/24 the artist’s annual auction turnover was only $36.1 million (giving him 5th place in our global ranking), and his Jim Beam – J.B. Turner Train fetched just $16.9 million.

Another example is the case of Christopher WOOL, the 7th top-selling Contemporary artist in the world with $33.6 million in 22/23, compared with $50.2 million the previous year. In May 2023, an untitled work from the Gerald Fineberg collection, estimated at $15 – 20 million by Christie’s, sold for just $10 million. At the same time, another canvas, Untitled (1988), estimated at $10 – 15 million by Sotheby’s, fetched just $8.37 million, which is only half the price it fetched at Christie’s in 2017 ($17.1 million).

But while works by Jeff Koons and Christopher Wool received more cautious support from the market, one artist maintained his exceptional price momentum: Jean-Michel BASQUIAT, whose very name evokes the exponential financial potential of the Contemporary art market.

10% of the segment’s global turnover carried by Basquiat

Basquiat is a veritable pillar of the Contemporary art market, in the same way that Picasso is for Modern Art. Sales of his works regularly generate approximately 10% of the global auction turnover on Contemporary art and his paintings are indeed the most valued on the market. In 2022/2023 no less than six of the eleven results above the $10 million threshold were for works by Basquiat. Among them, his El Gran Espectaculo (The Nile) (1983) was the only Contemporary work to fetch over $50 million. A monumental piece made up of three painted panels over 3.5 meters long, the painting sold for $67.1 million. The sale of this emblematic work, exhibited in various museums around the world, illustrates the spectacular capital gains that the best Jean-Michel BASQUIAT works can generate. Acquired at auction in 2005 for $5.1 million, its value was multiplied by 13 after just 18 years (Christie’s New York, 05/15/2023). Another example: his canvas Sugar Ray Robinson sold for $32.6 million in November 2022 at Christie’s, 15 years after its acquisition for $7.3 million at the same auction house.

Phenomenal value increases, worth millions of dollars, have accelerated in recent years for the artist who is honored as the first Contemporary African-American genius. In May 2022, Phillips sold a major canvas for $85 million compared to a previous price of $57 million in 2016 (Untitled《无题》, 1982). And of course we have not forgotten his canvas In This Case (1983) that was bought for less than a million dollars at Sotheby’s in 2002, and resold for $93.1 million at Christie’s in 2021, adding a staggering 92.1 million to its acquisition price of nearly twenty years earlier.

Only Jean-Michel Basquiat was capable of attracting bids above $50 million this year.

Basquiat is one of the few blue-chip artists whose resales have generated significant increases in value this year; but what about the so-called ‘red-chip’ artists, those from the new generation whose prices have soared so quickly on the international art market? Has the enthusiasm they enjoyed recently waned, or is it continuing? Which artists’ markets have slowed like many of the blue-chips, and which artists are collectors discovering and bringing to the fore? The second part of this report looks at the ‘hottest’ segment of the market: that of the Ultra-contemporaries – artists under the age of forty.

40.3

40.3